-

ICMag and The Vault are running a NEW contest! You can check it here. Prizes are seeds & forum premium access. Come join in!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Trump Bomber

- Thread starter igrowone

- Start date

- Status

- Not open for further replies.

Too bad the GOP just gave all those rich people all that ‘extra’ money.....

I’m sure your truth-defending friends pointed out to you that if we keep on exactly as we’re set NOW, that the-year figure hits 49 trillion, so you tell me, sport - what’s it gonna be? *YOU* got the extra 16+ trillion? How’s that ‘run the government like a business’ bullshit working out for us?

Trump trillion-dollar-plus deficits are putting America on a path to fiscal ruin

https://www.usatoday.com/story/opin...r-plus-deficits-fiscal-ruin-column/986236002/

The numbers are in, and Trump's tax cut didn't reduce the deficit – despite his many promises

https://www.cnbc.com/2018/10/16/tru...e-the-deficit--despite-his-many-promises.html

'Shrink the government' and 'make it more efficient' indeed.

You guys are hilarious. The debt is slated to grow at the slowest percentage rate since Clinton was President, we just had a President that added more debt than every prior President combined, and NOW you have discovered fiscal responsibility. Funny stuff!

https://www.thebalance.com/us-debt-by-president-by-dollar-and-percent-3306296

What you're missing entirely in this argument is that private insurance contributions and direct expenditures already far exceed that number. If instead of every employer that provides health care for workers was to pay in to a single-payer fund, the money would easily be available and with collective bargaining and oversight the prices would be lower. So the government would have to collect more money(sort of. taxes don't work like most people think they do), but overall it would be saving the taxpayers a lot of money. This is especially true if all the employers that do not provide health insurance have to start paying in too. The per-capita payments for companies would be lower but the available services per capita would be much better.

I'm not missing anything with the argument, what you are missing is that you are advocating for tax rates in the 70+% percent region and that employer-paid insurance contributions are currently a deductible business expense.

You guys are hilarious. The debt is slated to grow at the slowest percentage rate since Clinton was President, we just had a President that added more debt than every prior President combined, and NOW you have discovered fiscal responsibility. Funny stuff!

https://www.thebalance.com/us-debt-by-president-by-dollar-and-percent-3306296

And when the 14th amendment is actually ENFORCED, debt should slow even more. But the mental gymnastics is god tier...

St. Phatty

Active member

I got your Pipe Bomb right here.

So the thread is about the trump bomber.

The conversation gets deflected to national health care and now the piraña are swarming and attacking. I expect to see something like this down the road in real life with more Sayocs coming out of the woodwork. Will someone please take away the dog whistles.

The conversation gets deflected to national health care and now the piraña are swarming and attacking. I expect to see something like this down the road in real life with more Sayocs coming out of the woodwork. Will someone please take away the dog whistles.

You guys are hilarious. The debt is slated to grow at the slowest percentage rate since Clinton was President, we just had a President that added more debt than every prior President combined, and NOW you have discovered fiscal responsibility. Funny stuff!

https://www.thebalance.com/us-debt-by-president-by-dollar-and-percent-3306296

Suuuuure.

https://www.cato.org/publications/commentary/budget-deficits-are-only-getting-bigger-under-trump

https://www.cnbc.com/2018/08/02/the-trump-administration-is-headed-for-a-gigantic-debt-headache.html

stadanko

Active member

So how do we fix it? Here's a good start:

https://www.washingtonpost.com/opin...2607289efee_story.html?utm_term=.05e58cc16a2c

https://www.washingtonpost.com/opin...2607289efee_story.html?utm_term=.05e58cc16a2c

I'm not missing anything with the argument, what you are missing is that you are advocating for tax rates in the 70+% percent region and that employer-paid insurance contributions are currently a deductible business expense.

Pure Fiction.

It's like Rudy says, "The truth isn't really the truth".

By the way, Where is Rudy? You know, Rudolph. Where is Rudolph?

Struggling with math?

The debt is growing at a slower pace than it did under Obama in spite of the fact that the debt would continue to grow if spending were neutral because the debt isn't being fully serviced.

Pure Fiction.

It's like Rudy says, "The truth isn't really the truth".

By the way, Where is Rudy? You know, Rudolph. Where is Rudolph?

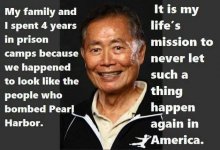

View Image

Gee, nice meme. Got ANY facts to go with that?

You guys are hilarious. The debt is slated to grow at the slowest percentage rate since Clinton was President, we just had a President that added more debt than every prior President combined, and NOW you have discovered fiscal responsibility. Funny stuff!

https://www.thebalance.com/us-debt-by-president-by-dollar-and-percent-3306296

in fairness, every new president has spent a lot more then the previous ones. i don't think Trump will be an exception when all is said and done. i mean he has started a new arms race, thats got to be expensive and the existing trade war he is waging will also not come cheap, depending on how long it lasts it could be disastrous for the whole worlds economy. Trump has vastly increased military spending, he increased military spending in Syria, he is set to break Obamas drone strike record if he goes on at the rate he is. so far he has been willing to waste a lot of money and non of it has gone for the wall or fixing the 3rd world roads bridges and tunnels. whether train tracks or hospitals, its all being ignored, even the electrical system is still mostly above ground, meaning any piddling storm knocks out peoples power. how will he fix all this stuff like he said, without spending money that belongs to the 5th generation from today or something like that.

thinking Trump will cut spending now, is a premature, wait till his term is nearly over and then count. from what i have been reading any money saved has been more then spent in other areas.

Struggling with math?

Gee, nice meme. Got ANY facts to go with that?

Facts don't matter with people who make them up constantly.

That was the point of the meme. I guess you didn't get it.

Try to stay on the trump bomber topic with facts. Two right wing nutcases attack and kill many in a single week. Twelve dead and over a dozen bombs mailed to politicians and media. People on this thread try to dismiss it as a left wing paid for conspiracy. Other right wingers seem to go along with that explanation. That's pathetic and demonstrates my expectation that there are many more such attacks out there festering. Instead of denouncing such behaviors, excuses are made implying denial.

Elsewhere, the same people, you included, advocate uncivilized taking children from their mothers at the border, never to be returned.

So, please don't share your views on national health care and try to justify our citizens being issued death sentences because they can not financially sustain the unrestrained raping and pillaging going on with corrupt medical pharmaceutical and insurance companies.

Klompen

Active member

I'm not missing anything with the argument, what you are missing is that you are advocating for tax rates in the 70+% percent region and that employer-paid insurance contributions are currently a deductible business expense.

You're pulling numbers completely out of thin air, and you're also ignoring my entire point. The total cost to employers and citizens will be less. Right now, society is paying more than that. It does not require doubling the median tax rate. That's such a simplistic way of looking at it.

You're pulling numbers completely out of thin air, and you're also ignoring my entire point. The total cost to employers and citizens will be less. Right now, society is paying more than that. It does not require doubling the median tax rate. That's such a simplistic way of looking at it.

This is exactly true. When people don't pay their hospital bills the tax payers pick up the tab at an exaggerated fee added rate.

You're pulling numbers completely out of thin air, and you're also ignoring my entire point. The total cost to employers and citizens will be less. Right now, society is paying more than that. It does not require doubling the median tax rate. That's such a simplistic way of looking at it.

No, I'm not. The article that I linked earlier stated explicitly that doubling of the current tax rates would fail to cover the cost of medicare-for-all. Your "total cost to employers" is currently a tax deductible business expense, you can't simply transfer the gross cost and declare it a savings. Doubling the cost of the annual federal budget is going to require the doubling of revenue, and once the government gets even further involved in dictating health care, costs will increase immeasurably. My example earlier of the net cost of filling a Norco script going up by 90x was due to the doctor's practice being taken over by a FQHC (Federally Qualified Health Center) because the doctor was tired of the bullshit mandates being put on him, simply wanted to practice medicine, and sold his practice to an entity that must jump through all of the government's hoops.

White Beard

Active member

I was asked to clarify...

I was asked to clarify...

Wikipedia:

TL;DR == a method to resolve opposing views on an issue by arriving at a synthesis, or distilled agreement/understanding between parties.

Hope that helps!

I was asked to clarify...

Hegelian dialectic is an method of resolving differences between *opposing* opinions; the meme posted simply lists four (imaginary) steps that follow each other ‘logically’, making more of a syllogism than a dialectic. The meme erases the inherent tension between thesis and antithesis.This graphic was created by someone who knows *nothing* about Hegel OR his dialectic materialism. Sheer BS masquerading as a philosophical resolution...

Wikipedia:

Dialectic or dialectics, also known as the dialectical method, is at base a discourse between two or more people holding different points of view about a subject but wishing to establish the truth through reasoned arguments

TL;DR == a method to resolve opposing views on an issue by arriving at a synthesis, or distilled agreement/understanding between parties.

Hope that helps!

You're pulling numbers completely out of thin air, and you're also ignoring my entire point. The total cost to employers and citizens will be less. Right now, society is paying more than that. It does not require doubling the median tax rate. That's such a simplistic way of looking at it.

To be fair Klompen, you are claiming it won't cost what Rives has said it will cost. You haven't given any estimates. I used the current cost of Medicare, to at least give an estimate. The estimates don't jibe with what you say.

Your economic situation you have referenced is Keynesian economics. It's proved time and time again to be a failure. The Bush/ Obama stimulus debacle has without a doubt proved that. Welfare spending might prop up McD's, and Walmart. Welfare spending is not, what started Google, Tesla, Microsoft, PayPal, Ford. These are true drivers of the economy not welfare . Hey at least you will help your favorite Billionaire Walton family.

if you have a 1 payer system, then every penny people are spending in the whole US from A to Z could be going towards the new system. health care in the US is already one of the highest in the world. imagine what could be done with that money if it was streamlined into 1 central system. you shouldn't need great tax increases, you rechannel all the money being spent already.

think about it, every insurance company has to employ the same people, with a transparent system the public would demand the pharma industry give their meds are reasonable prices, instead of hundreds of ceo's of every insurance company you have 1, there are many potential ways to use the money being spent right now to cover everyone.

you have to start from birth, and the rate has to go up as the medical needs go up in the general population. if you only insure sick and old people, of course it won't work, you need to be far thinking, you pay while you a bit every month, so when you need it the care will be there, or when your family needs it. healthcare is much more effective if there is no financial worries for those recovering from operations. you need a system that doesn't mean people have to sell their house or let their relative die

think about it, every insurance company has to employ the same people, with a transparent system the public would demand the pharma industry give their meds are reasonable prices, instead of hundreds of ceo's of every insurance company you have 1, there are many potential ways to use the money being spent right now to cover everyone.

you have to start from birth, and the rate has to go up as the medical needs go up in the general population. if you only insure sick and old people, of course it won't work, you need to be far thinking, you pay while you a bit every month, so when you need it the care will be there, or when your family needs it. healthcare is much more effective if there is no financial worries for those recovering from operations. you need a system that doesn't mean people have to sell their house or let their relative die

if you have a 1 payer system, then every penny people are spending in the whole US from A to Z could be going towards the new system. health care in the US is already one of the highest in the world. imagine what could be done with that money if it was streamlined into 1 central system. you shouldn't need great tax increases, you rechannel all the money being spent already.

think about it, every insurance company has to employ the same people, with a transparent system the public would demand the pharma industry give their meds are reasonable prices, instead of hundreds of ceo's of every insurance company you have 1, there are many potential ways to use the money being spent right now to cover everyone.

you have to start from birth, and the rate has to go up as the medical needs go up in the general population. if you only insure sick and old people, of course it won't work, you need to be far thinking, you pay while you a bit every month, so when you need it the care will be there, or when your family needs it. healthcare is much more effective if there is no financial worries for those recovering from operations. you need a system that doesn't mean people have to sell their house or let their relative die

You do realize that the profits from the insurance, and related industries are owned by the stockholders. How many 401k's, and pensions and stockholders are invested in these industries. So, those companies have to be dissolved, the value of the investments will vanish overnight. This means millions of people will lose a good chunk of their retirement and pensions. Externalities are not considered, so the money spent, and the wealth lost are not the same.

- Status

- Not open for further replies.