maybe we should have a sticky for metals prices.

I got way laid by the Google info bar that comes up at the top of a search.

https://www.kitco.com/finance/metals/ << PMs

http://www.kitcometals.com/ << base metals

maybe we should have a sticky for metals prices.

I got way laid by the Google info bar that comes up at the top of a search.

IMO, the problem with phyzz is the BS of the electronic price. Try to buy bars or especially coins at spot. So when you value a coin or bar, you have to figure the premium. That is where dealers make their money usually, in normal times. They buy and won't give you any premium over spot, but charge whatever the market will bear on sales.

So true!Gold @$1900 in 2020 dollars is not the same as Gold @$1900 in 2011 dollars.

So true!

But for some reason, the old highs often serve as resistance years, even decades later. Look at Silver in the 80s when it ran to 50, and then in 2011 when it ran to 50 again. Silver@50 in 2011 dollars is not the same as Silver@50 in 1980's dollars, but the 50 mark served as resistance in both cases despite the inflated money supply. Silver has a boatload of catching up to do. Gold leads silver follows, albeit sometimes with a delay.

...it's hard to get ahead investing in PMs.

Especially if you don't sell into super strength like that last upleg in 2011, and hodl until the next cycle low, like the end of 2015.This is something most bugs are quite familiar with.

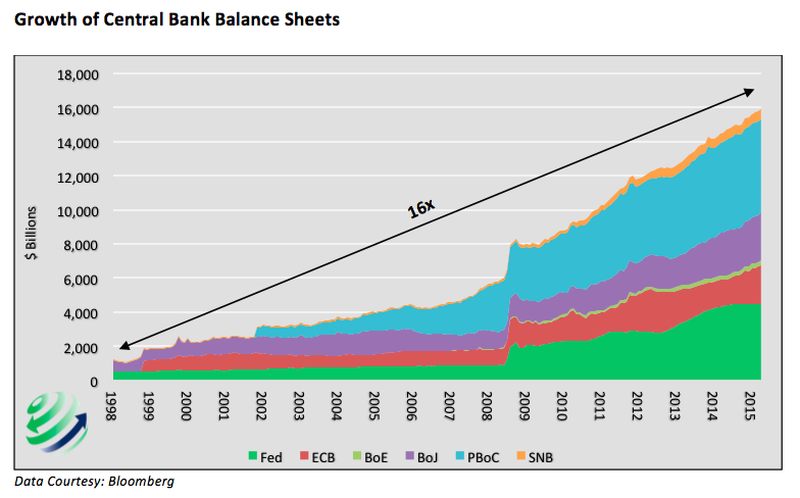

That is easy to look back and say, but stackers stacked because of the chart I put up above. That toothpaste isn't getting put backin the tube. National debts are not going to ever be repaid either. That is just the mechanism the bankers will use to take all the assets the .guv "owns". Like roads (make toll roads), land (sell it off), etc.

IMO, the way to play the ratio and remain stacked is trade between the metals somehow. I have never done it, as physical metals have a lot of transaction drag (fees, costs, risk). Maybe a shop would trade, but you can bet there will be a price.

[/FONT]...Those you trade based on NAV, or when the difference between spot and paper is so great, buy the paper and let it catch up in price to phyzz.

Yeah, it's crazy right now, and getting worse. Every presidential cycle, the US debt increased at an increasing rate. US Debt under the Donald is going to make US debt under the Baroque look like a skid mark rather than toilet-clogging dump. US debt under Donald 2/Creepy Joe (doesn't matter who the next president is) is going to be a manure pile. The madness keeps going until at some point when control is lost and not regain-able, "they" reset back to a new zero point with a few tweaks here and there, and the process continues on. The world is probably closer than its ever been to a loss of control since Nixon took the US...the World, off the gold standard. Time to buckle up....They are talking about the feds paying 70% of people's paychecks. When does this madness end? We are at $26T+ debt now.