ScissorMeTimber

Member

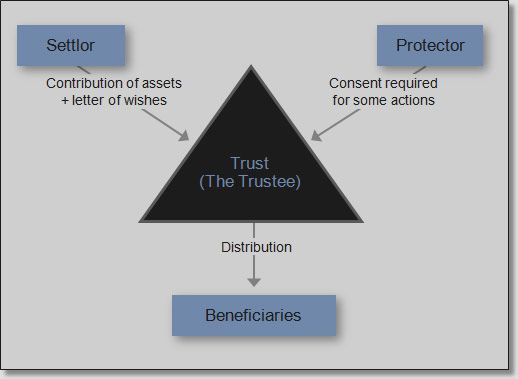

Make sure you have a trust set up to deal with EVERYTHING after you die. Family, friendly or not, suck and will find a way for screw the remaining family when you die.

I am getting everything so locked down that when I go nothing can or will happen against my wishes.

This goes for funeral plans, money, possessions and debt. Take care of your business now so things won't be so messed up later.

Learned from experience more than once.

I am getting everything so locked down that when I go nothing can or will happen against my wishes.

This goes for funeral plans, money, possessions and debt. Take care of your business now so things won't be so messed up later.

Learned from experience more than once.