What a surprise!

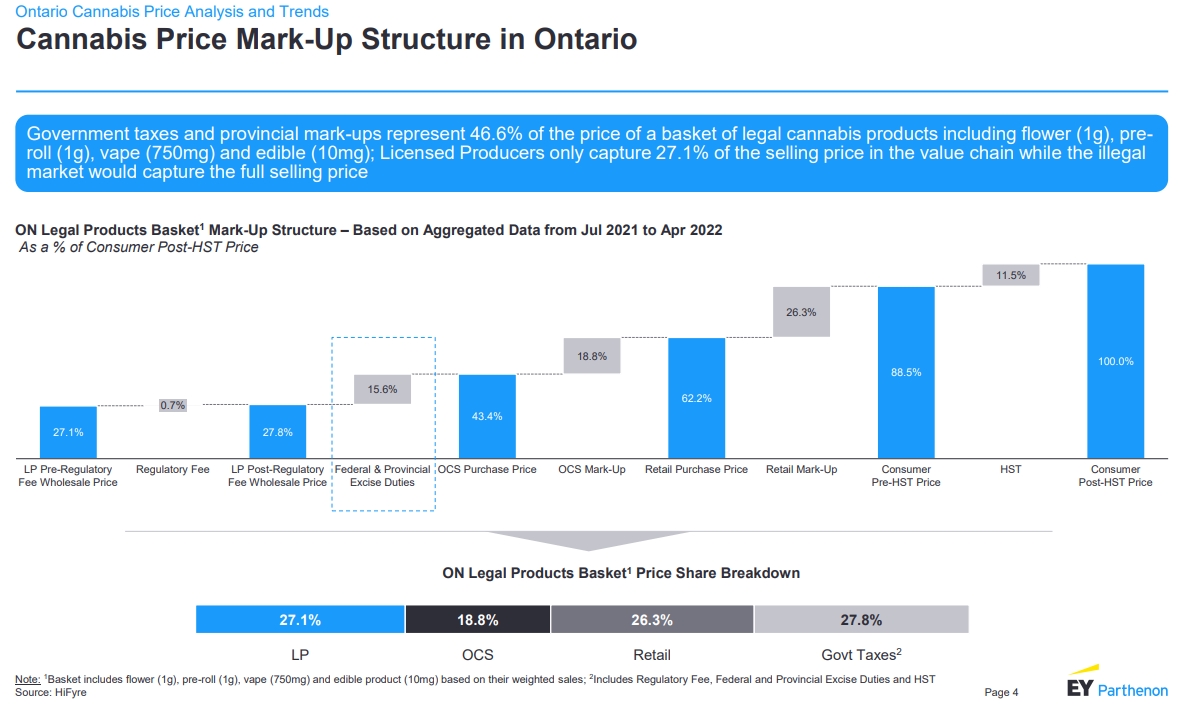

"The report, provided by EY Parthenon on behalf of the Cannabis Council of Canada, shows that government taxes and provincial mark-ups represent nearly 50% of the price of cannabis products in Ontario.

This brings into question the sustainability of the legal cannabis industry, concludes the report, with some, especially larger public licensed producers in Canada on the verge of bankruptcy.

The report calls on a reduction of federal and provincial excise duty rates, the creation of a single harmonized federal excise stamp rather than provincial ones, a reduction of regulatory fees, a potential increase in edibles potency limits, less restrictive marketing regulations and packaging requirements, and increased enforcement against the black market."

Source: Statcann

Cannabis Council Report PDF (data below on pg 4)

"The report, provided by EY Parthenon on behalf of the Cannabis Council of Canada, shows that government taxes and provincial mark-ups represent nearly 50% of the price of cannabis products in Ontario.

This brings into question the sustainability of the legal cannabis industry, concludes the report, with some, especially larger public licensed producers in Canada on the verge of bankruptcy.

The report calls on a reduction of federal and provincial excise duty rates, the creation of a single harmonized federal excise stamp rather than provincial ones, a reduction of regulatory fees, a potential increase in edibles potency limits, less restrictive marketing regulations and packaging requirements, and increased enforcement against the black market."

Source: Statcann

Cannabis Council Report PDF (data below on pg 4)