Kingpin: Marijuana Funding Model Starts to Take Shape

By Tim Sprinkle | Yahoo! Finance – Thu, Feb 14, 2013 4:23 PM EST

http://finance.yahoo.com/news/kingpin--marijuana-funding-model-starts-to-take-shape-212346330.html

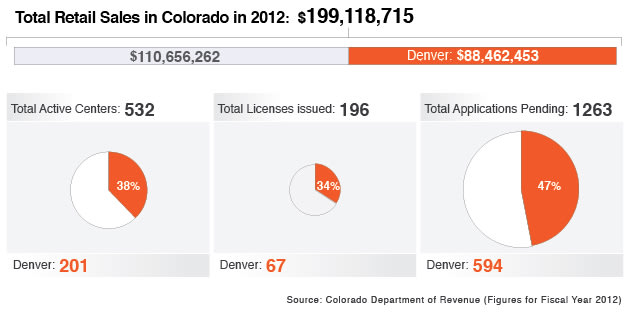

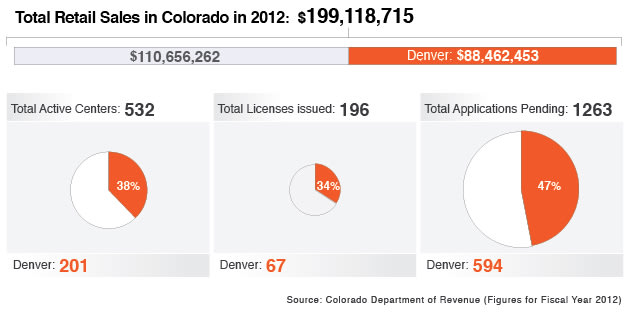

Photo, video and graphic by Siemond Chan

When Ean Seeb and his business partners founded Denver Relief, their medical marijuana dispensary in downtown Denver’s Baker neighborhood in 2008, it was strictly a bare-bones effort. No fancy interior decor, no proprietary strains or products, no state-of-the-art grow house. Their inventory at the time was as limited as their personal bank accounts.

After all, as a cannabis business they did not have access to traditional bank loans and had to literally bootstrap their way up the hard way, borrowing seed money from friends, family and employees and building out the operation one step at a time.

“Denver Relief started with $4,000 and a half pound of pot,” Seeb jokes now, referring to the business’s meager beginnings, but it has since grown into a mini marijuana empire that’s one of the best known and most established of its kind in Colorado. In addition to its 1,500-square-foot dispensary, Denver Relief now offers cannabis business consulting services and wellness treatments and it operates its own cultivation facility.

None of this came cheap – building out the retail operation was a six-figure project, Seeb says, and setting up their 13,000-square-foot hydroponic cultivation facility cost them more than $500,000 – and funding has always been a challenge. Marijuana is still illegal under federal law, despite the fact that it is now legal for adult “recreational” use in Colorado and Washington State and for medicinal use in 14 additional states. Most banks remain unwilling to do any sort of business with cannabis operators due to federal regulations such as the Bank Secrecy Act, which requires financial institutions to report potential criminal activity to the government. That means no small business loans, no revolving credit lines and no credit card transaction services. Some operators have even had trouble getting access to a basic business checking account.

[Related Video: Watch Denver Relief owner Ean Seeb talk about the challenges of doing business in an unsure regulatory climate by clicking on the tiles below.]

Leveling the field

But that could all soon be changing.

Denver Relief is currently in the process of setting up a $10 million investment fund that will allow interested backers to invest directly in the cultivation and operational side of the industry, as well as in ancillary businesses (grow equipment, lighting solutions, etc.). On track to launch by May of this year, the fund will offer debt-side investments starting at $100,000. (As of now, the state of Colorado requires that equity investors in the state’s marijuana businesses be Colorado residents; no such regulation applies to debt investments.)

Most notably, however, this fund could become a lifeline for startup operators and growers, bringing seed capital and true business financing to the cannabis industry for the first time.

“We’ll see how it goes,” Seeb says, “but we are absolutely working with very successful individuals who have proven successes in the past and have come to us because of our expertise in the industry... It’s been very nice that people want to come and work with us and they’re starting to recognize the work that we’ve done over the last several years.”

Denver Relief won’t be the first cannabis-focused investment fund on the market – Yahoo! Finance profiled two of the primary competitors in this space, Privateer Holdings and The ArcView Group, in January – but by offering funding to cash-strapped operators and grow houses, it could well carve out a unique niche for itself in this fledgling industry.

“If you’re looking to be involved in this industry, there’s an opportunity through us and we can help with that,” Seeb says.

By Tim Sprinkle | Yahoo! Finance – Thu, Feb 14, 2013 4:23 PM EST

http://finance.yahoo.com/news/kingpin--marijuana-funding-model-starts-to-take-shape-212346330.html

Photo, video and graphic by Siemond Chan

When Ean Seeb and his business partners founded Denver Relief, their medical marijuana dispensary in downtown Denver’s Baker neighborhood in 2008, it was strictly a bare-bones effort. No fancy interior decor, no proprietary strains or products, no state-of-the-art grow house. Their inventory at the time was as limited as their personal bank accounts.

After all, as a cannabis business they did not have access to traditional bank loans and had to literally bootstrap their way up the hard way, borrowing seed money from friends, family and employees and building out the operation one step at a time.

“Denver Relief started with $4,000 and a half pound of pot,” Seeb jokes now, referring to the business’s meager beginnings, but it has since grown into a mini marijuana empire that’s one of the best known and most established of its kind in Colorado. In addition to its 1,500-square-foot dispensary, Denver Relief now offers cannabis business consulting services and wellness treatments and it operates its own cultivation facility.

None of this came cheap – building out the retail operation was a six-figure project, Seeb says, and setting up their 13,000-square-foot hydroponic cultivation facility cost them more than $500,000 – and funding has always been a challenge. Marijuana is still illegal under federal law, despite the fact that it is now legal for adult “recreational” use in Colorado and Washington State and for medicinal use in 14 additional states. Most banks remain unwilling to do any sort of business with cannabis operators due to federal regulations such as the Bank Secrecy Act, which requires financial institutions to report potential criminal activity to the government. That means no small business loans, no revolving credit lines and no credit card transaction services. Some operators have even had trouble getting access to a basic business checking account.

[Related Video: Watch Denver Relief owner Ean Seeb talk about the challenges of doing business in an unsure regulatory climate by clicking on the tiles below.]

Leveling the field

But that could all soon be changing.

Denver Relief is currently in the process of setting up a $10 million investment fund that will allow interested backers to invest directly in the cultivation and operational side of the industry, as well as in ancillary businesses (grow equipment, lighting solutions, etc.). On track to launch by May of this year, the fund will offer debt-side investments starting at $100,000. (As of now, the state of Colorado requires that equity investors in the state’s marijuana businesses be Colorado residents; no such regulation applies to debt investments.)

Most notably, however, this fund could become a lifeline for startup operators and growers, bringing seed capital and true business financing to the cannabis industry for the first time.

“We’ll see how it goes,” Seeb says, “but we are absolutely working with very successful individuals who have proven successes in the past and have come to us because of our expertise in the industry... It’s been very nice that people want to come and work with us and they’re starting to recognize the work that we’ve done over the last several years.”

Denver Relief won’t be the first cannabis-focused investment fund on the market – Yahoo! Finance profiled two of the primary competitors in this space, Privateer Holdings and The ArcView Group, in January – but by offering funding to cash-strapped operators and grow houses, it could well carve out a unique niche for itself in this fledgling industry.

“If you’re looking to be involved in this industry, there’s an opportunity through us and we can help with that,” Seeb says.