Bob Knudsen, Examiner.com 6/23/2015

The good news on marijuana legalization in Colorado keeps rolling in, this time in the form of lower prices for the drug. In fact, in some cases it’s down as much as 40 percent--not bad for any product, let alone the fastest growing industry in the nation. It seems that basic economics are actually true; if you increase supply and reduce regulation it will create a boom market.

A little over a year ago an eighth of an ounce ranged in price anywhere from $40 to $75, depending on the strain and the shop. Now those same eighths are selling for as low as $30, according to the Denver Post on June 22. Some were worried that the steep price decline was a sign of a market crash and perhaps an oversaturation of the market, but those concerned don’t seem to include actual cannabis businesses.

In fact, businesses are still reporting massive growth in sales numbers as long time residents, new transplants, and pot tourists flock to the state by the thousands, fueling a huge economic boom, with all the good and bad that can bring with it. In fact, the biggest problem in Denver right now is that the city is growing so fast right now that nobody can keep up with it. Homes can’t be built fast enough, rents are rising too quickly, and infrastructure is struggling to keep up with a city that could start bursting at the seams soon.

With marijuana prices now dropping like a rock, Colorado's growth rate may actually increase even further as people from states who would rather imprison peaceful potheads and empower drug cartels continue to crack down in increasingly insane ways. Neighboring Oklahoma and Nebraska have filed suits against the Centennial State for having the sense to decriminalize, and Kansas is considering throwing a single mother in jail for life for having Crohn’s disease and using medical marijuana to cope with it. All three of those states growth rates are half as much, or lower, than Colorado’s… but that’s probably unrelated.

The biggest problem facing cannabusiness is currently what to do with all of the money that seems to be falling from the sky. The federal government is still giving banks a hard time about accepting deposits, preferring to erect barriers to the money in order to keep it out of the economy. Meanwhile, the state legislature is also trying to figure out what to do with the the tens of millions of dollars in tax revenue that has overflowed their coffers, though you can be assured they will keep it and waste it if given the chance. They aren’t altogether unreasonable, however, as they are planning to have a one day tax holiday for marijuana sales on September 16, thanks to a loophole that they’ve decided to leave open, and soon after that the sales tax for all marijuana purchases will be permanently reduced to 8 percent. It will be interesting to see what the sales and prices do on that day.

Really, the only people being hurt by the legalization of marijuana are the Mexican drug cartels, who have been experiencing a major drop in business. While the governments of uneducated midwestern states are doing what they can to continue to prop up these violent criminal enterprises, Colorado's massive price drop is probably the biggest blow to them that could be expected. If this trend continues, marijuana will only be profitable for the cartels in states where it’s still illegal, and even there the price reduction will likely be felt.

The downside of Denver.....wonder if it will be reminiscent of

"Tulipmania", economic . In the 1630s a sailor was thrown in a Dutch jail for eating what he thought was an onion. That onion was in fact a tulip bulb. The cost of the sailor’s gluttony was equivalent to the cost of feeding an entire crew for twelve months.

That story is probably not true—no sane person would leave something so valuable for an absent-minded seaman to chew on. But like much about tulipmania, the line between fact and fiction is blurred.

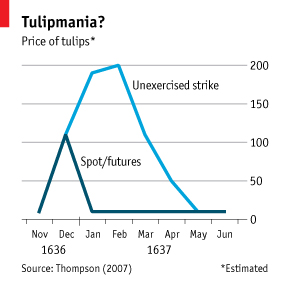

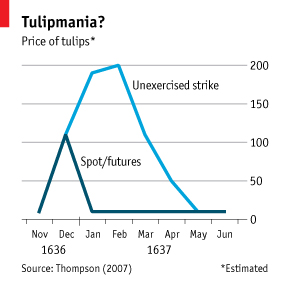

“Tulpenwoede” (tulip madness) resulted in big increases in tulip prices. At the beginning of 1637, some tulip contracts reached a level about 20 times the level of three months earlier. A particularly rare tulip, Semper Augustus, was priced at around 1,000 guilders in the 1620s. But just before the crash, it was valued at 5,500 guilders per bulb—roughly the cost of luxurious house in Amsterdam. Prices collapsed in February 1637—although data here are particularly poor—and a few investors were left bankrupt.

The price swings were not caused by massive changes to production costs. Nor did tulips suddenly become particularly useful. As a result, most people assume that tulipmania was the result of financial market irrationality. That idea was popularised by Charles Mackay, a mid-19th<SUP> </SUP>century Scottish writer. Most modern-day references to tulipmania draw on Mackay’s work. But economic historians provide better explanations for what happened.

Peter Garber blames the general public for the price increases. He reckons that an outbreak of bubonic plague in Amsterdam made people less risk-averse. Dutch city-dwellers knew that each day could be their last—so did not mind indulging in a little speculation. And because gambling was illegal, contracts were unenforceable. If traders misjudged the market, they could just run off without paying.

See a trend???

The good news on marijuana legalization in Colorado keeps rolling in, this time in the form of lower prices for the drug. In fact, in some cases it’s down as much as 40 percent--not bad for any product, let alone the fastest growing industry in the nation. It seems that basic economics are actually true; if you increase supply and reduce regulation it will create a boom market.

A little over a year ago an eighth of an ounce ranged in price anywhere from $40 to $75, depending on the strain and the shop. Now those same eighths are selling for as low as $30, according to the Denver Post on June 22. Some were worried that the steep price decline was a sign of a market crash and perhaps an oversaturation of the market, but those concerned don’t seem to include actual cannabis businesses.

In fact, businesses are still reporting massive growth in sales numbers as long time residents, new transplants, and pot tourists flock to the state by the thousands, fueling a huge economic boom, with all the good and bad that can bring with it. In fact, the biggest problem in Denver right now is that the city is growing so fast right now that nobody can keep up with it. Homes can’t be built fast enough, rents are rising too quickly, and infrastructure is struggling to keep up with a city that could start bursting at the seams soon.

With marijuana prices now dropping like a rock, Colorado's growth rate may actually increase even further as people from states who would rather imprison peaceful potheads and empower drug cartels continue to crack down in increasingly insane ways. Neighboring Oklahoma and Nebraska have filed suits against the Centennial State for having the sense to decriminalize, and Kansas is considering throwing a single mother in jail for life for having Crohn’s disease and using medical marijuana to cope with it. All three of those states growth rates are half as much, or lower, than Colorado’s… but that’s probably unrelated.

The biggest problem facing cannabusiness is currently what to do with all of the money that seems to be falling from the sky. The federal government is still giving banks a hard time about accepting deposits, preferring to erect barriers to the money in order to keep it out of the economy. Meanwhile, the state legislature is also trying to figure out what to do with the the tens of millions of dollars in tax revenue that has overflowed their coffers, though you can be assured they will keep it and waste it if given the chance. They aren’t altogether unreasonable, however, as they are planning to have a one day tax holiday for marijuana sales on September 16, thanks to a loophole that they’ve decided to leave open, and soon after that the sales tax for all marijuana purchases will be permanently reduced to 8 percent. It will be interesting to see what the sales and prices do on that day.

Really, the only people being hurt by the legalization of marijuana are the Mexican drug cartels, who have been experiencing a major drop in business. While the governments of uneducated midwestern states are doing what they can to continue to prop up these violent criminal enterprises, Colorado's massive price drop is probably the biggest blow to them that could be expected. If this trend continues, marijuana will only be profitable for the cartels in states where it’s still illegal, and even there the price reduction will likely be felt.

The downside of Denver.....wonder if it will be reminiscent of

"Tulipmania", economic . In the 1630s a sailor was thrown in a Dutch jail for eating what he thought was an onion. That onion was in fact a tulip bulb. The cost of the sailor’s gluttony was equivalent to the cost of feeding an entire crew for twelve months.

That story is probably not true—no sane person would leave something so valuable for an absent-minded seaman to chew on. But like much about tulipmania, the line between fact and fiction is blurred.

“Tulpenwoede” (tulip madness) resulted in big increases in tulip prices. At the beginning of 1637, some tulip contracts reached a level about 20 times the level of three months earlier. A particularly rare tulip, Semper Augustus, was priced at around 1,000 guilders in the 1620s. But just before the crash, it was valued at 5,500 guilders per bulb—roughly the cost of luxurious house in Amsterdam. Prices collapsed in February 1637—although data here are particularly poor—and a few investors were left bankrupt.

The price swings were not caused by massive changes to production costs. Nor did tulips suddenly become particularly useful. As a result, most people assume that tulipmania was the result of financial market irrationality. That idea was popularised by Charles Mackay, a mid-19th<SUP> </SUP>century Scottish writer. Most modern-day references to tulipmania draw on Mackay’s work. But economic historians provide better explanations for what happened.

Peter Garber blames the general public for the price increases. He reckons that an outbreak of bubonic plague in Amsterdam made people less risk-averse. Dutch city-dwellers knew that each day could be their last—so did not mind indulging in a little speculation. And because gambling was illegal, contracts were unenforceable. If traders misjudged the market, they could just run off without paying.

See a trend???

In off the road villages in this state where alcohol is illegal you can get $200-300 for a jug of home brewed beer or pruno.

In off the road villages in this state where alcohol is illegal you can get $200-300 for a jug of home brewed beer or pruno.